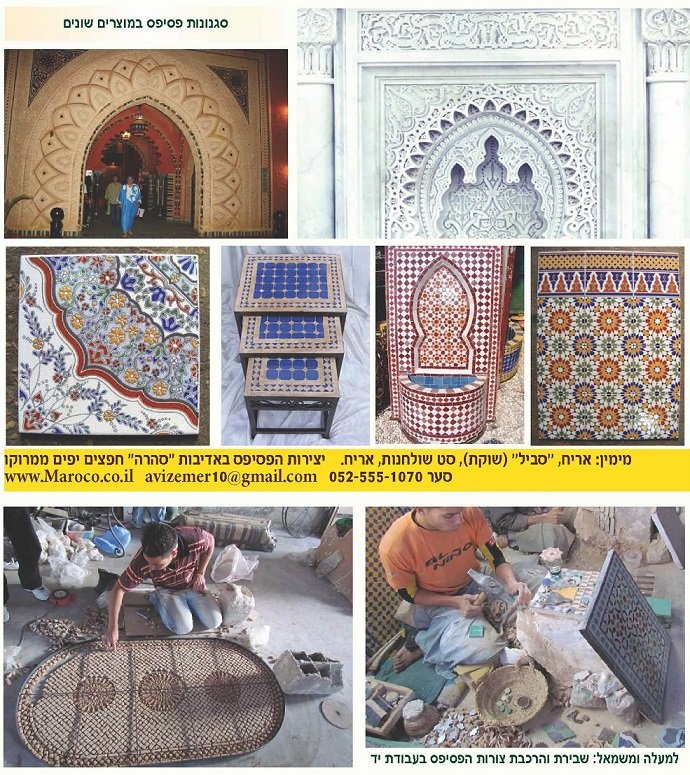

סהרה - חפצים יפים ממרוקו, מטיילים עם אביזמר למרוקו,שולחן פסיפס, טאג'ין, ריהוט מרוקאי, תורכיז, טיולים למרוקו, מדריך למרוקו - כלי קרמיקה ואריחים

סהרה - חפצים יפים ממרוקו, מטיילים עם אביזמר למרוקו,שולחן פסיפס, טאג'ין, ריהוט מרוקאי, תורכיז, טיולים למרוקו, מדריך למרוקו - כלי קרמיקה ואריחים

סהרה - חפצים יפים ממרוקו, מטיילים עם אביזמר למרוקו,שולחן פסיפס, טאג'ין, ריהוט מרוקאי, תורכיז, טיולים למרוקו, מדריך למרוקו - כלי קרמיקה ואריחים

סהרה - חפצים יפים ממרוקו, מטיילים עם אביזמר למרוקו,שולחן פסיפס, טאג'ין, ריהוט מרוקאי, תורכיז, טיולים למרוקו, מדריך למרוקו - כלי קרמיקה ואריחים

סהרה - חפצים יפים ממרוקו, מטיילים עם אביזמר למרוקו,שולחן פסיפס, טאג'ין, ריהוט מרוקאי, תורכיז, טיולים למרוקו, מדריך למרוקו - מוצרים